Introduction

After the collapse of South Carolina’s once robust textile industry, the state was littered with closed and abandoned textile mills. In 2004, the South Carolina Textile Communities Revitalization Act (the “Act”) was enacted with the purpose of incentivizing the renovation and rehabilitation of these sites, which were causing community disruption, hindered investment, the lowering of property values, and increasing crime and safety concerns.

The Act provides for a tax credit of up to twenty-five percent (25%) of certain rehabilitation expenses for taxpayers renovating qualified textile mills sites. This paper is intended to examine the eligibility requirements, procedure, qualified expenses, and administration of the Act. The Act and applicable guidance are complex, and there are often unanswered questions based on the taxpayer’s specific circumstances and attributes of the property, which require a legal analysis. It is strongly advised that the taxpayer engage competent counsel for advice and assistance early and throughout the process. An experienced attorney’s services will also be valuable in helping determine strategies to maximize the credit under the law and available tax guidance.

Eligibility Requirements

For a textile mill site to qualify under the Act, it must have an abandoned textile mill on the site, as those terms are defined.1 A “textile mill” is a facility “initially used for textile manufacturing, dying, or finishing operations and for ancillary uses to those operations.2 “Ancillary uses” consists of:

- Sales;

- Distribution;

- Storage;

- Water runoff;

- Wastewater treatment and detention;

- Pollution control;

- Landfill;

- Personnel offices;

- Security offices;

- Employee parking;

- Dining and recreation areas; and

- Internal roadways or driveways associated with such uses.3

If the textile mill site was acquired on or after January 1, 2008, the qualifying area of the site is limited to the boundaries of the textile mill or other structures devoted to ancillary uses.4 However, if (a) the site was acquired prior to January 1, 2008, (b) it is located near Interstate 77 near the Catawba River, or (c) it is located in a “distressed area” of the state, as determined by the applicable council of government (such as, for instance, the Appalachian Council of Governments for some counties in the South Carolina Upstate region), the qualifying area is broader.5 It then includes the textile mill structure itself and all land and improvements used directly for title manufacturing or ancillary uses, on the same parcel or “a contiguous parcel within one thousand feet of any textile mill structure or ancillary uses.”6 “Contiguous parcel” is defined as any tax parcel sharing a common boundary with an adjacent parcel or separated only by a road or railroad right of way.7

The textile mill site must also be abandoned to qualify. “Abandoned” means that, for at least one (1) year immediately preceding the taxpayer’s filing of a “Notice of Intent to Rehabilitate” (more on that below), at least eighty percent of the textile mill has been continuously closed to business, or otherwise nonoperational.8 An abandoned textile mill may also be subdivided into separate parcels, and each parcel is deemed to be its own textile mill site for determining abandonment.9

Notwithstanding, a taxpayer is not eligible for the credit if it owned the subject textile mill site when it was operational and immediately prior to abandonment.10

Certification of Eligibility

The above requirements may seem simple at first, but it is not uncommon for questions to arise regarding the eligibility of the site. Fortunately, the Act provides that the taxpayer may seek

certification from the county or municipality wherein the site is located that the site qualifies, which certification can be in the form of an ordinance or binding resolution of council.11 Obtaining the certification as soon as possible is strongly advised. The statute allows for the taxpayer to “conclusively rely upon the certification,” as long as a copy is included on the first state tax return for which the credit is claimed.12

Election of Credit

The A taxpayer who rehabilitates a textile mill site may be eligible for either a credit of twenty-five percent (25%) of actual qualified rehabilitation expenses against ad valorem real property taxes (the “property tax credit”) or against income taxes, corporate license fees or insurance premium taxes (the “income tax credit”).13 Each election has different procedural requirements and rules.

Procedure and Rules When Electing the Property Tax Credit

If the taxpayer elects the property tax credit, it must file a Notice of Intent to Rehabilitate (a “NIR”) with the municipality wherein the site is located, or county if in an unincorporated area.14 A NIR is a letter submitted by the taxpayer including: 1) A statement indicating the taxpayer’s intent to rehabilitate the site; (2) The location of the site; (3) The acreage of the site; (4) The estimated expenses to be incurred in the rehabilitation; (5) Information as to which buildings the taxpayer intends to renovate or demolish; and (6) Whether new construction is to be involved.15 For the property tax credit election, the NIR must be provided prior to the taxpayer having incurred the first rehabilitation expenses for the site.16 Failure to do so results in qualification of only the expenses incurred after the NIR is provided.17

It is crucial that the taxpayer provide as accurate of an estimate of expenses as possible in the NIR. If, when seeking the property tax credit, the actual rehabilitation expenses are below eighty percent (80%) of the estimated expense number provided in the NIR, the entire credit is disallowed.18 If the actual expenses are more than one hundred twenty-five percent (125%) of the expense number provided, the expense amount for determination of the credit is limited to that one hundred twentyfive percent number.19 The South Carolina Department of Revenue (“SCDOR”) has advised that it will not accept an amended NIR to revise the estimated rehabilitation expense amount, nor to revise the number of parcels being rehabilitated.20

After the taxpayer provides the NIR, the governing council of the county or municipality must then determine by resolution the eligibility of the textile mill site and the proposed rehabilitation expenses for the credit, and the proposed rehabilitation must be approved by a positive majority vote.21 Council must then give notice to all affected local taxing entities (e.g. school districts and fire districts) of its intention to grant the credit, including the estimated credit amount based on the estimated rehabilitation expenses in the NIR,22 and a subsequent public hearing and ordinance are required23.

The property tax credit can be taken against up to seventy-five percent (75%) of the real property taxes due, for up to eight (8) years.24 It may be claimed beginning in the property tax year in which the site is placed in service (or applicable phase if the site is developed in phases).25 The date that the site (or applicable phase thereof is “placed in service” is the date that it is completed and ready for its intended use.26

Procedure and Rules When Electing the Income Tax Credit

The income tax credit option is most often chosen by taxpayers for financial reasons, possible syndication of the credit, or because the procedure when electing the income tax credit is much

less onerous.

If the property was acquired or before January 1, 2008 and the income tax credit is elected, the taxpayer must file a “NIR” with SCDOR prior to receiving the building permits for the

rehabilitation.27 (Note the difference in timing of filing the NIR for the income tax credit versus the property tax credit.) Failure to file prior to receiving the building permits means that only those rehabilitation expenses incurred after delivery of the NIR qualify towards the credit.28 No approval or vote of a county or municipality is required to receive the income tax credit.29 As mentioned above however, it is still recommended that the taxpayer obtain a certification resolution or ordinance from the applicable county or municipal council.

If the textile mill site has been subdivided into several textile mill sites, a separate NIR should be filed for each subdivided site.30 In this case, it is possible for the taxpayer to obtain the income tax credit on any subdivided site, and the property tax credit for any other. In this event, SCDOR should be notified of any NIR provided to a municipality or county for obtaining the property tax credit.31 If there is only one textile mill site, but the development would be completed in phases, the taxpayer will only file one NIR for the entire site.32

Unlike with the property tax credit election, there is no disqualification of the income tax credit if the actual rehabilitation expenses incurred come in below eighty percent (80%) of the estimate provided in the NIR.33 However, actual expenses over one hundred twenty five percent (125%) of the estimate included are still disallowed.34 Therefore, it is advisable as a strategy when electing the income tax credit that the taxpayer include a high-end estimate in the NIR.

If the tax mill site was acquired prior to January 1, 2008, the taxpayer is not required to file an NIR to obtain the income tax credit.35

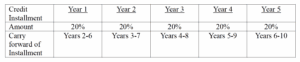

The income tax credit is applicable to the taxable year in which the site (or applicable phase thereof) is placed in service, but must be taken in equal installments over a five-year period.36 Any unused credit for a year may be carried forward for the succeeding five (5) years.37 By way of illustration:

The credit may be taken at the individual, partnership or limited liability level.38 So if the taxpayer is a partnership or limited liability company which has elected pass-through taxation, the credit may be taken by the partnership partners or limited liability company members, as applicable, to the extent any of those partners or members was a partner or member during which the credit is allocated.39

If the textile mill site is leased, the taxpayer may transfer any or all of the income tax credit to the tenant and the same pass-through rule for the taxpayer applies to the tenant.40 The taxpayer may also transfer all or a portion of the credit to a purchaser of the site.41 The transferor is required to notify SCDOR within thirty days.42

The income tax credit itself cannot be bought nor sold,43 however, though there are certain commonly used strategies for monetization of the income tax credit through syndication utilizing

the pass through allocation rules.

Qualified Rehabilitation Expenses

The income tax credit option is most often chosen by taxpayers for financial reasons, possible syndication of the credit, or because the procedure when electing the income tax credit is much less onerous.

As mentioned, the tax credit under the Act is for up to twenty-five percent (25%) of qualified “rehabilitation expenses”, a defined term. They include “expenses and capital expenditures incurred in the rehabilitation, renovation, or redevelopment of a textile mill site” such as “for the partial or complete demolition of existing buildings, environmental remediation, site

improvements, the construction of new buildings and other improvements…”44 However, expressly excluded are any costs of acquiring the textile mill site, land, and other improvements.45Costs of acquisition include the purchase price and associated professional fees (e.g., title work, surveying, closing costs), and interest on the acquisition loan.46 Also excluded are expenses that increase the amount of square footage of the buildings that existed on a contiguous parcel immediately preceding the time at which the textile mill was abandoned, by more than two hundred percent (200%).47

For any expenses to qualify, the building or buildings on the site must be either renovated or demolished.48

SCDOR guidance suggests a broad scope in determining qualified expenses.49 For an existing building, interior demolition, movement of walls, replacing floors, ceilings or roofs, wall-to-wall carpeting, permanent titles and paneling, central HVAC systems, plumbing, electrical wiring, fixtures, sprinkler systems and elevators should all qualify.50 Environmental remediation expenses should also qualify including, without limitation, lead paint abatement, asbestos or mold removal, and underground storage tanks removal. Site and other improvement expenses such as for sidewalks, fences, docks, landscaping, drainage or paving may also qualify, as well as professional fees associated with redevelopment costs, including for engineering and architectural fees, and interest costs on the construction loan.51 Qualified expenses paid under a tenant improvement allowance in a lease for all or part of the site, for customization of the space, may be included as well.52

Personal property costs, such as for office furniture, certain appliances, and window treatments, are excluded from qualified expenses.53 Personal property is generally a moveable item which is not “permanently affixed” to the land or building.54 In determining whether an item is considered personal property, SCDOR will consider (1) the mode of attachment; (2) the character of the structure or article; (3) the intent of the parties making the annexation; and (4) the relationship of the parties.55 SCDOR may also consider how costly, time consuming and destructive to the building removal of the item would be.56 This determination may be different than for other income tax purposes.57

Conclusion

The South Carolina Textile Communities Revitalization Act is complex, but understanding the law and utilizing the tax credits offered therein can yield substantial value to those wanting to rehabilitate textile mill sites in the state. As mentioned, however, questions often arise in relation to the statute which remain unanswered. It is crucial that the taxpayer to have engaged competent, experienced counsel early and throughout the process to analyze the facts under the law, ensure compliance, and strategize for maximum the benefit.

_______________________________________________________________________________________________________

1 See generally S.C. CODE ANN. § 12-65-30 (2014); S.C. CODE ANN. § 12-65-20(1)-(3), (4)(a) (2014 & Supp. 2023).

2 S.C. CODE ANN. § 12-65-20(3) (2014). Note the word “initially”, which may suggest that a facility which was repurposed from textile purposes before its abandonment could qualify. Conversely, it may also suggest that a facility which was initially used for non-qualifying purposes but later repurposed for textile usage may not qualify.

3 S.C. CODE ANN. § 12-65-20(2).

4 S.C. CODE ANN. § 12-65-20(4)(a) (Supp. 2023).

5 S.C. CODE ANN. § 12-65-20(4)(b) (Supp. 2023).

6 Id.

7 Id.

8 S.C. CODE ANN. § 12-65-20(1) (2014).

9 Id.

10 S.C. CODE ANN. § 12-65-30(D) (2014).

11 S.C. CODE ANN. § 12-65-60 (2014).

12 Id.

13 S.C. CODE ANN. § 12-65-30(A) (2014).

14 S.C. CODE ANN. § 12-65-30(B)(1) (2014).

15 S.C. CODE ANN. § 12-65-20(9) (2014).

16 S.C. CODE ANN. § 12-65-30(B)(1) (2014).

17 Id.

18 S.C. CODE ANN. § 12-65-30(B)(3)(a) (2014).

19 Id.

20 2015 SC Tax Advisory Ops. LEXIS 33, *20-21.

21 S.C. CODE ANN. § 12-65-30(B)(2) (2014).

22 S.C. CODE ANN. § 12-65-30(B)(4) (2014).

23 S.C. CODE ANN. § 12-65-30(B)(2) (2014).

24 S.C. CODE ANN. § 12-65-30(B)(3)(a) (2014).

25 S.C. CODE ANN. § 12-65-30(B)(5) (2014).

26 S.C. CODE ANN. § 12-65-20(7) (2014).

27 S.C. CODE ANN. § 12-65-30(C)(2) (Supp. 2023).

28 Id.

29 See generally S.C. CODE ANN. § 12-65-30(C) (Supp. 2023).

30 2015 SC Tax Advisory Ops. LEXIS 33, *21-22.

31 Id.

32 Id.

33 See generally id.

34 Id.

35 S.C. CODE ANN. §§ 12-65-20(9) (2014) and 12-65-30(C)(2) (Supp. 2023); 2015 SC Tax Advisory Ops. LEXIS 33, *28-30.

36 S.C. CODE ANN. § 12-65-30(C)(3) (Supp. 2023).

37 Id.

38 S.C. CODE ANN. § 12-65-30(C)(6)(a) (Supp. 2023).

39 S.C. CODE ANN. § 12-65-30(C)(7) (Supp. 2023).

40 S.C. CODE ANN. § 12-65-30(C)(6)(a) (Supp. 2023).